What is Preponderance of Evidence?

When you’re filing or defending a personal injury claim, the outcome often comes down to one critical legal standard: the preponderance of the evidence. It’s the burden of proof you, as the plaintiff, must meet to win your case. But what does that actually mean?

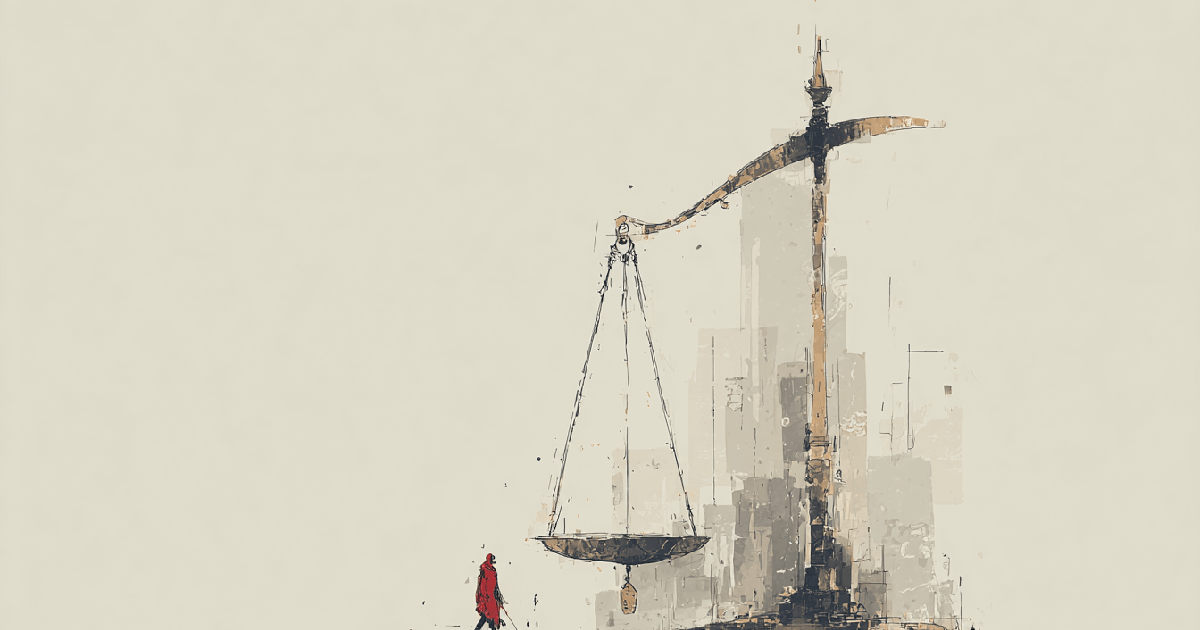

In simple terms, preponderance of the evidence means that your version of events is more likely true than not—just over 50% likely. It’s not about proving your case beyond all doubt; it’s about tipping the scales in your favor, even slightly.

What does preponderance of the evidence mean in a civil case?

In a civil case like a personal injury lawsuit, the plaintiff must convince the judge or jury that it’s more likely than not that the defendant is legally responsible for the injury. This standard is called the preponderance of the evidence, and it is much lower than the criminal standard of “beyond a reasonable doubt.”

Think of it like a balancing scale: if the evidence tips even slightly in your favor, you’ve met the burden.

It requires showing that your version is more likely than not to be true—even by a small margin.

It’s the standard used in nearly all personal injury claims, including car accidents, slip and falls, and medical malpractice.

It applies to each element of the case, such as proving negligence, causation, and damages.

The judge or jury decides if the standard has been met after reviewing all admissible evidence.

How is the preponderance standard different from “beyond a reasonable doubt”?

The two standards serve different purposes. Beyond a reasonable doubt is used in criminal trials and is the highest standard in law—designed to protect individuals from wrongful conviction. In contrast, preponderance of the evidence is used in civil trials and reflects the less severe consequences at stake.

This lower threshold means a plaintiff in a personal injury case doesn’t need overwhelming evidence—just enough to tip the balance.

Preponderance = just over 50% certainty; it’s a more-likely-than-not standard.

Beyond a reasonable doubt = near certainty, often explained as around 95% confidence.

Civil cases require only preponderance, because the penalties are financial, not criminal.

Jurors don’t need to be fully convinced—just reasonably persuaded that your side is stronger.

What kind of evidence meets the preponderance standard?

Any evidence that is credible, admissible, and relevant can contribute toward meeting the preponderance standard. This includes physical proof, documents, testimony, and expert opinions. The key is not quantity, but quality and persuasiveness.

Both sides present their evidence, and it’s up to the judge or jury to determine which story makes more sense.

Medical records and bills show the extent and cause of injuries.

Photographs or video may establish how an accident occurred.

Eyewitness testimony can support or refute claims about the incident.

Expert witnesses, such as accident reconstructionists or doctors, help explain complex facts.

Why does preponderance of the evidence matter in settlement negotiations?

Even outside of court, the preponderance standard shapes how both parties evaluate a case. Insurance adjusters and defense attorneys consider whether your case would likely win at trial based on the evidence you’ve provided. If they believe it crosses the preponderance threshold, they’re more likely to settle—often for a fair amount.

Conversely, if your case appears weak, they may dig in or make a lowball offer.

Stronger evidence means more leverage in negotiations, as your likelihood of winning increases.

If your case clearly meets the preponderance standard, insurers may want to avoid trial.

Weak or incomplete evidence may result in delayed or denied claims.

Attorneys build cases around this standard, making sure each element is backed by credible proof.

Conclusion

Preponderance of the evidence is the legal backbone of every personal injury claim. It’s the threshold you must meet to win—proving that your version of events is more likely true than not. While it’s not an impossible standard, it does require solid evidence and strategic presentation. Understanding this concept helps you grasp what’s needed to move your case forward and secure the compensation you deserve.

What is preponderance of the evidence?

Preponderance of the evidence is the standard of proof in civil cases, meaning the plaintiff must show that their version of events is more likely true than not. It’s commonly described as tipping the scale just slightly in your favor—more than 50%.

How much evidence is needed to meet this standard?

There’s no fixed amount. It’s not about how much evidence you have, but whether it’s strong and persuasive enough to convince a judge or jury that your claim is more likely true than false.

Who has the burden of proof in a personal injury case?

The plaintiff (the injured party) carries the burden of proof. They must provide enough credible evidence to meet the preponderance standard for each element of their case.

Can you win a case if the evidence is evenly balanced?

No. If the judge or jury feels the evidence is equally convincing on both sides, the plaintiff loses. You must tip the scale in your favor—however slightly—to prevail.

Featured Articles

-

Glossary

What is Doctrine of Avoidable Consequences?

What is Doctrine of Avoidable Consequences? What is the doctrine of avoidable consequences in personal injury law?The doctrine of avoidable consequences is a legal.

-

Glossary

What is Independent Medical Examination?

What is Independent Medical Examination? What is an independent medical examination in personal injury law?An independent medical examination (IME) is a medical evaluation requested by.

-

Glossary

What is Collateral Estoppel?

What is Res Judicata? What is collateral estoppel in personal injury law?Collateral estoppel, also known as “issue preclusion,” is a legal rule that prevents.

Explore our Contributors

Discover Next

Insights from Experts

Learn from industry experts about key cases, the business of law, and more insights that shape the future of trial law.